Guide to the Fideicomiso: Buying Property in Mexico as a Foreigner

For foreigners looking to invest in Mexican real estate, the fideicomiso, or Mexican bank trust, is a vital tool. Established to allow non-Mexican citizens to buy property in certain “restricted zones,” which include areas within 100 kilometers (about 62 miles) of the border and 50 kilometers (about 31 miles) from the coast, the fideicomiso has become a popular option for those seeking property in prime coastal destinations like Puerto Vallarta, Riviera Maya, and Cabo San Lucas.

If you’re considering investing in Mexican real estate, here’s everything you need to know about the fideicomiso and how it works.

What is a Fideicomiso?

A fideicomiso is a trust agreement that allows foreigners to legally acquire and enjoy full rights over property within restricted zones. This arrangement involves a Mexican bank, which holds the title to the property on behalf of the foreign buyer. Essentially, the bank acts as a trustee, while the buyer becomes the beneficiary, enjoying all ownership benefits, including the right to lease, transfer, or sell the property.

The fideicomiso was established to address constitutional restrictions that prevent foreigners from owning land in restricted zones. However, through this bank trust, non-Mexican citizens can enjoy the rights of ownership without violating Mexican law.

Key Features of the Fideicomiso

- Duration: The fideicomiso has an initial term of 50 years, and it is renewable indefinitely in 50-year increments. This means that foreigners can effectively maintain ownership for generations.

- Bank Involvement: The Mexican bank, as trustee, holds the legal title, but the beneficiary (foreign buyer) retains all rights to manage, sell, or transfer the property.

- Rights of the Beneficiary: The fideicomiso grants full rights, including the ability to rent out the property, remodel, or even sell it. Beneficiaries can also pass on the fideicomiso to heirs, ensuring generational ownership.

- Cost: Setting up a fideicomiso typically costs around $500 to $1,000 USD, depending on the bank and region. There is also an annual fee, generally between $400 and $600 USD, for maintenance of the trust.

How to Set Up a Fideicomiso

- Choose a Property: Identify a property in the restricted zone you wish to purchase. Working with a local real estate expert, especially one familiar with the fideicomiso process, can streamline your search.

- Appoint a Bank: Once you’ve found a property, choose a Mexican bank to act as your trustee. Several banks offer fideicomiso services, so compare fees and services before deciding.

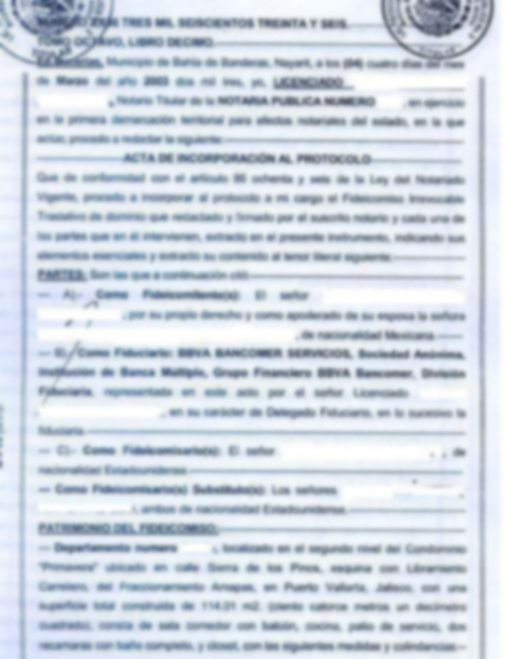

- Formalize the Agreement: You, as the buyer, negotiate terms with the bank, specifying all the rights and obligations within the fideicomiso. The bank will then apply for the permit from Mexico’s Ministry of Foreign Affairs.

- Sign and Register: Once approved, you’ll sign the fideicomiso agreement, which is then registered with the public registry, officially securing your rights to the property.

Benefits of the Fideicomiso

- Legal Security: As the beneficiary, you hold all the rights over the property without violating Mexican law. This structure is backed by Mexican legislation, making it a secure choice for foreign buyers.

- Investment Flexibility: The fideicomiso allows for inheritance and resale, meaning you can pass on the property to your heirs or resell it without complications. Additionally, renting it out is a simple process, enabling you to generate income from your investment.

- Renewable Terms: The 50-year renewable term provides the potential for long-term ownership, making it an ideal vehicle for legacy investments.

Is the Fideicomiso Right for You?

If you’re looking to invest in property within Mexico’s restricted zones, the fideicomiso is one of the only legal ways to do so as a foreigner. The process, while involving some costs and legal formalities, is well-regulated and widely trusted. Many foreign investors have successfully used the fideicomiso to own properties in Mexico’s sought-after coastal regions and enjoy a secure, long-term investment.

Common Questions

- Can I cancel the fideicomiso if I no longer want the property? Yes, if you sell the property, the fideicomiso can be canceled or transferred to the new buyer. This process requires legal formalities, but it is straightforward.

- Can I change banks? Yes, you can transfer the fideicomiso to another bank if needed. However, this may incur additional fees.

- Does the fideicomiso give me full ownership? While the bank technically holds the title, you, as the beneficiary, have full rights, including the ability to manage, lease, sell, and bequeath the property.

Conclusion

The fideicomiso is an effective legal tool that has opened Mexico’s stunning coastal real estate to foreign investors. By securing full ownership rights through this trust, foreign buyers can invest with confidence, knowing they have a solid legal framework that protects their interests. With beautiful destinations like Puerto Vallarta and other coastal paradises offering attractive investment potential, the fideicomiso is a reliable option for making your Mexican dream a reality.